What is compound interest?

Interest accrued on a savings account is compounded when added to the interest already accrued. Compound interest, sometimes known as "interest on interest," causes a payment to increase more rapidly than simple interest, which is computed just on the principal. Money grows rapidly via compounding. The compound interest will get larger if more periods are used for compounding. Investing with compound interest may be beneficial, but carrying a balance with it can be challenging.

The concept of compound interest

When the value of interest accumulated over a loan or investment's term fluctuates, the claim is calculated using a process known as compound interest. A loan's or investment's interest earnings are reapplied to the principal balance at the end of each accounting period. Therefore, interest for each term is calculated using the inflated principal amount to provide a unique and improved rate of return.

The calculation process is what sets compound interest distinct from basic interest. The interest rate on a simple interest investment remains constant during the life of the investment since it is based only on the principal. Compound interest has entered the public lexicon and is sometimes cited as the "eighth wonder of the world," a title supposedly bestowed upon it by the great Albert Einstein.

The power of compounding is the source of its fame. Compounding refers to the annualized frequency with which interest is added to or subtracted from the principal. Annually, semiannually, quarterly, monthly, and even daily interest compounding are all possible. Therefore, the principal is worth more money the more often it is compounded.

Elements of compound interest

The four primary parts of compound interest are as follows:

· The principal

The initial sum placed into a compounding account (such as a high-interest bank savings account) is known as the principal. The initial principal balance is the base from which interest is accrued.

· Rate of interest

It is the annual percentage yield of the account. Interest will be paid at a rate determined by the account's value (the initial principal plus accrued interest).

· The frequency of compounding

The number of times per year interest is compounded is set by the compounding frequency. Since high-frequency compounding is often only accessible with lower rates, it will affect the interest rate. The frequency of compounding is often monthly, quarterly, or annually.

· Time limits

The period over which compound interest may be earned is called the "time horizon." More interest may be accrued over a longer period, leading to a bigger final balance.

The time frame over which compound interest is calculated is crucial, as it determines the investment's potential for future return. A compounding system with low interest and compounding rates might still be appealing if the available time horizon is extremely lengthy.

Calculating compound interest

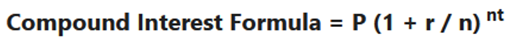

Annual, quarterly, monthly, semiannual, and daily computations may be done using the same basic formula for compound interest (CI). The formula for compound interest is as shown below:

Below is a more detailed explanation of the equation described above and its components:

· The ultimate sum, denoted by the letter A, is the total of future returns for an investment.

· The letter P stands for the principal sum invested, which is the initial amount of investment;

· The letter "r" stands for the "interest rate" or "rate of return" at which compounding occurs.

· "n" is the "number of times" interest is compounded on the provided amount. If interest is compounded twice a year, n = 6, meaning interest is paid twice yearly.

· For how many years, denoted by "t," do you want to leave your cash invested?

To predict how much interest will be earned in the future, we use the formula:

CI = A – P

CI may be calculated by taking the future value of the invested amount and subtracting the original investment.

The power of compound interest

Interest that has compounded over time rises at an ever-increasing rate since it incorporates the interest earned in prior periods. Long-term investment returns may be greatly increased by compound interest.

Time frames for compound interest

Interest on an account accumulates over time in increments called compounding periods. There is no "right" frequency for interest compounding; it may be done yearly, semiannual, quarterly, monthly, daily, or continuously.

You may be charged interest daily yet get payments just once a month. Accrual of compound interest begins once interest is credited to the account balance. Many types of financial products adhere to standard compounding frequency schedules:

i. Money market accounts and savings accounts: Bank savings accounts typically have a daily compounding period.

ii. CD or certificate of deposit: Daily and monthly cycles are the most common for CD compounding.

iii. Bonds in Series I: Interest is added to the principal every six months or every half year.

iv. Loans: monthly interest compounding is common practice for many types of loans. On the other hand, "interest capitalization" is another term for compounding interest that may be used in the context of student loans.

v. Using a credit card: Credit card interest may quickly become a significant burden when compounding daily.

Banks that provide "continuously compounding interest" contribute to the principal balance every time interest is calculated. The extra interest above daily compounding is little unless you plan to deposit and withdraw funds on the same day.

Periodic compounding rate

Any investor or creditor would benefit from interest being compounded more often. The inverse is true for a borrower. If you want more compound interest, you must increase the number of compounding periods.

Begin saving early

Most millennials do not bother to put any money down for old age. With more time to save, they may be able to prioritize other, more pressing costs. However, if you save early, compounding interest may work to your advantage, even with small sums of money. Saving even a tiny amount each month may have a huge impact, often outweighing the benefits of saving a larger sum later.

Benefits of compound interest

· Contributes to a secure financial future via long-term saving and investing. Returns on investments and savings benefit from compounding since they, in turn, generate further returns.

· The risk of wealth deterioration is reduced. Inflation and other forms of cost-of-living inflation are both things that may eat away at your money, but the exponential growth of compound interest can help you keep more of what you earn.

· Loan repayments may benefit from compounding: The power of compounding may work in your favor to reduce your overall interest costs if you pay more than the required minimum each month.

Drawbacks of compound interest

· Reduces the purchasing power of customers by making minimal payments on high-interest loans or credit card debts since the amount may continue to increase exponentially if the borrower makes the minimum payment required each month. How easy it is to get into a "debt cycle."

· You must pay taxes on your earnings: Unless the interest is earned in a tax-deferred account, compound interest earnings are subject to taxation at the individual's normal tax rate.

· Problematic for estimation: Compound interest needs more arithmetic to calculate than simple interest. It may be simpler to use a calculator you find online.

Investing in compound interest

The returns on a retirement plan or savings account that delivers compound interest are often more lucrative than those on a plan or account that pays simple interest. The returns will grow exponentially if the compounding period is extended.

If interest is compounded quarterly, payments will be made four times a year. As a result, it will provide more financial rewards than yearly compounding, when interest is paid just once a year. Therefore, the greater the investment's potential return, the longer it is held. In contrast, withdrawals will reduce earnings.

On the contrary, debtors choose loans with simple rates over those with compounding principal balances. Borrowers dealing with compounding interest rates are advised to pay off their debts as quickly as feasible.

Even if stocks and 401(k)s do not yield such interest rates, the force of compounding gives them an early advantage over other assets. The value of a 401(k) account grows over time because of the compounding effect of reinvesting dividends and interest payments from stocks and bonds. Additionally, dividends from certain corporations qualify for REIT reinvestment.

Therefore, the effectiveness of compounding is intrinsically tied to the habit of saving. When investing opportunities permit compounding, the more you save, the more money you will make. Bonds, CDs, credit cards, and several bank accounts and loans all provide the possibility of compound interest.

Therefore, one must accurately evaluate compounding values before choosing between a loan and an investment. The manual process of calculating a sequence of future numbers may be time-consuming. Hence several online calculators have made their way onto the web. These calculators, including the SEC, may be found on government websites and can be adjusted for yearly, monthly, quarterly, or daily compounding.

Investments with compound interest

An investor may use compound interest over time by automatically reinvesting dividends in the account.

One method for investors to reap the benefits of compound interest is via dividend-paying assets like stocks and mutual funds. Dividends that are reinvested are utilized to buy more of the underlying asset. Then, the bigger investment will accrue interest at a faster rate.

In addition, buyers of zero-coupon bonds get compound interest on their investments. Interest payments on conventional bonds are made at regular intervals and are determined by the bond's original terms. Interest does not accumulate on these distributions since checks are used.

The holders of zero-coupon bonds are not compensated with interest payments. Instead, the value of this bond increases with time and may be acquired at a discount. To ensure that the entire face value of a zero-coupon bond gets paid at maturity, issuers often rely on the power of compounding.

Compound interest calculators available online

Several online compound interest calculators are available at no cost as well.

· Investor.gov Online compound interest calculator is free from the United States SEC. It is easy to use, and you can even plug in more funds each month to the principal to see how much interest you will make over time.

· The CalculatorSite.com compound interest calculator provides options for automated computation of inflation-adjusted increases for monthly deposits or withdrawals and supports calculations in five different currencies.

· The Council for Economic Education Compound Interest Calculator: This calculator shows pupils the long-term benefits of compound interest. Put in your current age, the desired rate of return, the amount you can invest initially, and the amount you can save monthly. The resultant graph displays your savings growth and the interest accrued over the years.

Who benefits from compound interest?

Every kind of investor may reap the rewards of compound interest. Banks may reap the benefits of compound interest by lending money and then using the interest on those loans to make further loans. People who put money into savings accounts, bonds, or other assets get the benefits of compound interest.

Conclusion

The long-term impact of compound interest on investments and savings is substantial. Compound interest is crucial to building wealth because it multiplies your initial investment significantly quicker than basic interest. Inflation, which causes costs to rise, is somewhat offset by this. Young individuals may take advantage of the time worth of money by investing in compound interest. The interest rate is not the only thing to consider when picking an investment; the number of compounding periods is also crucial.