What is an exponential moving average?

An exponential moving average (EMA) is an economic indicator used in marketing that indicates how the value of a stock or other security varies over time. The EMA differs from an SMA in that it gives more weight to recent data values, such as recent prices. The goal of all moving averages is to determine the trend in which the value of an asset is headed based on preceding prices. As a result, exponential moving averages are lagging indicators. They do not forecast future prices but illustrate the stock price pattern.

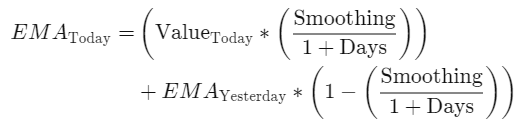

Formula for EMA

Where:

EMA = Exponential moving average

For the calculation of the current EMA, the following formula is usually used:

EMA = K * (Current price – Previous EMA) + Previous EMA;

K = 2/(n+1)

Where:

n = the selected period

Previous EMA is usually the initial EMA for the first calculations

Although there are other options for the smoothing factor, the most frequently used is; smoothing = 2.

Calculation of EMA

The analysis of EMA involves an additional assessment than the SMA. Assume you wish to utilize 10 days for the total quantity of assessments in the EMA. The SMA must then be obtained on the 10th day. The previous day's SMA can be used as the first EMA for the previous day on the 11th day.

The SMA calculation is basic. It is the total of the stock's closing prices during a given period divided by the total quantity of assessments. The multiplier for smoothing (weighting) the EMA must next be determined, a process which commonly embraces the formula: [2 (number of observations + 1)].

The exponential moving average assigns more weight to current prices, but the SMA gives equal weight to all data. For a shorter-period EMA, the weighting assigned to the most recent price is more prominent than for a longer-period EMA.

Perceiving the concept of EMA

The 12- and 26-day EMAs are often mentioned and studied as short-term averages. Percentage price oscillator (PPO) and moving average convergence divergence (MACD) indicators are created using the 12- and 26-day moving averages. Generally, the 50- and 200-day EMAs are utilized as perpetual trend indicators. Whenever the price of a company crosses its 200-day moving average, it is a technical indicator suggesting a reversal has happened.

Moving averages may be incredibly beneficial and enlightening for statistical analysis traders when used appropriately. They also know that when those indicators are misused or misconstrued, they may cause disaster. Moving averages are all lagging indicators that are often utilized in technical analysis.

As an outcome, any inferences made from employing a moving average to a specific market chart are expected to corroborate or signal the strength of a market move. The best opportunity to join the market frequently occurs before a moving average indicates that the trend has shifted.

To a certain extent, an EMA helps mitigate delays' harmful impact. Since the EMA computation gives more weight to the most recent data, it "hugs" the price movement a little tighter and reacts faster. This is beneficial when an EMA provides a trading entry indication.

Like all moving average indicators, EMAs work best in prevailing environments. The EMA indicator trend will show a rising trend when the market is in an impressive and persistent upswing and, inversely, when the market is in a downturn. A competent trader will consider the EMA trend's trajectory and the shifts' pace from one interval to the next. Assume the price movement of a strong uptrend begins to stagnate and decline. From the standpoint of opportunity cost, it may be time to move to a more optimistic investment.

Applications of the exponential moving average

- Pointing out trends. One of the most vital roles of an EMA is to point out and determine price patterns. A rise in EMA suggests that prices are rising, and the contrary is true. If the cost exceeds the EMA line, it is expected to increase; when it is below, it will decrease. The EMA identifies price directions, allowing investors and traders to discover purchasing and selling indicators depending on their investing plan.

- Bands of Support and Resistance. The EMA, along with various forms of moving averages, can serve as price support and resistance levels. Support levels are sometimes referred to as "floors" since they serve as the upper limit for the extent to which prices are predicted to decline during uptrends.

Examples of EMA Applications

EMAs are frequently combined with various indicators to verify and assess significant market changes. The EMA benefits investors who operate daily and in dynamic economies. Traders frequently use EMAs to detect an investment inclination. When an EMA on the daily graph indicates an impressive rising trend, a daily trader's approach could be solely trading on the long end of the spectrum. The EMA trading method works in the same way as the SMA. A purchase signal is generated when an immediate EMA rises above the more extensive EMA. Traders aim to take short positions when the immediate EMA falls below the long-term EMA. The values of EMA are entirely dependent on the investor's choice.

Pros of EMA

Below are some of the benefits of EMA:

- Serve as resistance and support levels. Like the other moving averages, the exponential moving average serves as resistance and support bands for the values of investments. Support levels, often known as floors, are fixed prices of securities below which no price can drop. On the other hand, a resistance level is a predefined price threshold of an economic tool over which its value cannot hike. Resistance levels are sometimes known as ceilings.

- Price fluctuation sensitivity. An EMA is far quicker than an SMA in detecting drastic fluctuations in the price levels of a financial instrument. As a result, EMAs can detect changes quicker than SMAs.

- Determines and verifies market trends. This counts as one of the most essential tasks of EMA. Whenever an EMA trend moves higher, it suggests an appreciation; when it moves downward, it signals a decline. When the EMA bar rises above the asset's price, the asset is expected to decline next. However, if the price value rises above the EMA line, it indicates that the asset's value will keep on rising. As a result, traders may spot signals for purchase and sale signals using the EMA as a graph marker.

The issues with exponential moving average

While the EMA provides the benefits mentioned above, they are not without drawbacks.

As previously stated, EMA prioritizes the latest and most recent data items. Numerous stakeholders feel this provides a more accurate depiction of an economic instrument's prevailing trend. Others believe too much attention to the most recent data points may lead to additional false alarms.

Furthermore, various economists believe that the economy is competitive. This implies that the current market values of securities include all the required information. As a result, any previous data is regarded as useless in estimating the potential future value of an investment.

Correlations between the SMA and the EMA

Even though they perform significantly distinct tasks, crypto traders use SMA and EMA similarly. Let's compare their related functions;

- Monitoring trends. Using the SMA and EMA indicators, you may determine if a trend is bullish or bearish by observing whether the price aligns with the indicators. Assume the price is greater than the simple or exponential moving average. When the price is above these moving averages, it is in an increasing trend; when it is lower than the moving averages, it is in a downward trend.

- Levels of support and resistance. People can use the SMAs and EMAs to determine market resistance and support to help trade cryptocurrency more efficiently. Once the price goes lower than any moving average and remains under it, the moving average develops resistance; when the price rises beyond the moving average and remains above it, the moving average forms support. Resistance levels prevent the price from rising, while support levels prevent the price from falling. Knowing the preceding information may help you monitor your investments using stop-loss and take-profit orders. A stop-loss level or cost is where you intend to exit a transaction if it persists in losing money, whereas a take-profit level is where you would like to secure your profits. When purchasing, your take-profit should be put before the next resistance, while your stop-loss should be set below the support. When trading, place your take profit before the subsequent support and your stop loss higher than the resistance.

- Breakouts confirmation. The SMA and EMA can be applied to identify and trade breakouts. A price breakout transpires when a value falls below the level of support and remains lower than it or when the price rises above a resistance level and remains above it. In a bullish breakout, the resistance becomes a support, whereas in a bearish breakout, the support becomes a resistance.

What is the distinction between EMA and SMA?

The main distinction between EMA and SMA is their adaptability to shifts in the data utilized in their computation.

In particular, the EMA lends more weight to recent prices, but the SMA gives equal weight to all prices. The two averages are comparable because they are employed by technical investors to level out price volatility and are viewed similarly.

Because EMAs give greater weight to current data than past data, they are considered more sensitive to recent price fluctuations than SMAs. This makes EMA findings easier to interpret, which is why many traders favor them.

However, it is crucial to note that none of the moving averages is a more significant indication than the other. For instance, while an EMA represents recent price fluctuations more accurately and helps spot patterns faster, it also suffers more short-term volatility than an SMA. The trading plan determines the best moving average to utilize for analysis.

EMA's Limitations

It is uncertain if the most recent days of the period should be given greater weight. Most investors feel that freshly acquired information better represents the security's current trend. Others believe that emphasizing recent dates generates an unfair advantage, resulting in additional erroneous alerts.

Conversely, the EMA is entirely dependent on past data. Numerous economists think economies are productive, meaning current market rates represent every bit of data accessible. If markets are effective, utilizing previous data should teach us little about stock price fluctuations in the future.

What is an effective EMA?

Long-term investors prefer longer-day EMAs (50 and 200 days), while short-term investors prefer 8- and 20-day EMAs.

Is the EMA superior to the SMA?

The EMA is more sensitive to current price movements; therefore, it reacts to price changes faster than the SMA.

How should you interpret EMA?

A rising EMA is usually seen as a support for price activity and a decreasing EMA as a resistance. Investors that follow this interpretation try to purchase when the price is close to the increasing EMA and sell when the price is close to the dropping EMA.

Conclusion

The investing methods used by investors determine the moving average approach. However, because it emphasizes current price points, the exponential moving average approach is frequently preferred over the simple moving average method. All investors must do is carefully review each moving average technique before implementing it into their investment strategy.