What is an interest rate?

The interest rate is the amount that a creditor charges a debtor and is expressed as a percentage of the principal, the cash lent. A loan's annual percentage rate (APR) is customarily stated every year. An interest rate can also be used for the amount generated at a financial institution from a savings account or certificate of deposit (CD). The income generated on these deposit accounts is denoted by the annual percentage yield (APY).

Perceiving the concept of interest rates

Interest is simply a fee levied against the debtor for their consumption of a security. Borrowed assets might include money, consumer products, automobiles, and real estate. As a result, an interest rate may be considered the "cost of money" - higher interest rates cause borrowing an equal sum of a loan costly.

Thus, interest rates apply to the majority of loan and borrowing activities. People often borrow cash to buy houses, pay school or college fees, start or fund enterprises, or fund initiatives. Businesses take out loans to support capital projects and grow their operations by acquiring fixed and capital assets such as machinery, land, and buildings. Borrowed funds are returned in a flat sum or monthly installments by a specific date.

The interest rate on loans is applied to the principle, which is the loan amount. The interest rate represents the debtor's loan cost and the creditor's rate of return. The amount to be repaid is frequently more significant than the sum borrowed since creditors seek remuneration for the loss of how to invest the funds over the loan period. Instead of offering a loan, the lender may have invested the cash, generating income from the stock. The interest charged distinguishes between the final payback amount and the original loan amount.

When a lender considers a borrower to be low-risk, the lender will typically charge a lower interest rate. If borrowers are deemed high-risk, their interest rate will be greater, resulting in a more expensive loan. Risk is often considered when a lender examines a potential debtor's credit history, so having an exceptional one is critical to be eligible for the finest loans.

Calculating interest rate

Interest rates can be either simple or compound. Simple interest is a set rate charged to the primary loan or deposit amount, whereas compound interest adds a rate to any accrued interest from prior periods.

- Simple interest (SI) rate

Simple interest = Principal * interest rate * time

- Compound interest (CI) rate

Certain creditors favor compound interest, implying that the debtor will pay much more. Compound interest, often known as interest on interest, is charged on both the principal and the accumulated interest from prior periods. The bank expects that the debtor owes the principal plus interest for the first year at the end of that year. The bank also anticipates that after the second year, the debtor owes the principal plus interest plus the compound interest for the first year.

When compounding, the interest owing is more than the interest due when utilizing the simple interest approach. The monthly interest is levied on the principal plus accumulated interest from previous months. The interest computation for shorter periods will be identical for both techniques. However, as the lending period lengthens, the discrepancy between the two forms of interest estimates rises.

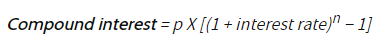

Compound interest may be calculated using the following formula:

Where:

p = Principal

n = number of compounding periods

Classifications of interest rates

Interest rates are categorized further based on the influence of major economic factors such as inflation. Interest rates can be nominal, real, or effective. Understanding the distinctions between all three may assist you in making more intelligent borrowing or investment choices and better grasping the entire cost of a loan or return on a deposit.

- Real interest rate. By deducting predicted projected price hikes from the nominal rate, the real interest rate takes inflation into account. Real rates are more beneficial for evaluating long-term investment alternatives since they let you calculate the genuine return on the asset after inflation.

- Effective interest rate. The effective interest rate is the actual return on deposit or borrowing cost after interest compounding and any related fees and levies are deducted. This rate may be determined using the nominal rate and compounding frequency. The effective interest rate provides a more realistic view of the loan or deposit product.

- Nominal interest rate. The declared yearly interest rate imposed on a loan or the returns on a deposit is referred to as the nominal rate. It does not take into account any extra costs or prices related to the goods, as well as the impact of inflation. Focusing simply on the nominal interest rate risks missing critical factors and setting unrealistic expectations about total costs or returns.

Factors affecting interest rates

While interest rates impact investment returns and loan repayment costs, they are also affected by factors such as inflation, the state of the economy, government policy, supply and demand, loan period, and credit risk.

- The state of the economy. The interest rate banks charge is affected by various factors, including the economy's strength. The interest rate established by a country's central bank (for example, the Federal Reserve in the United States) is used by each bank to determine the APR range it offers. When the central bank raises interest rates, the cost of debt rises. When the cost of borrowing is elevated, it discourages consumers from borrowing and decreases consumer demand. In addition, interest rates tend to grow in tandem with inflation.

- Inflation. Financial institutions may impose higher reserve requirements to prevent inflation, create a tighter money supply, or increase credit demand. People like to save money in a high-interest rate environment because the savings rate is higher. The financial sector suffers because investors would prefer to take advantage of greater savings rates than participate in the stock market, which offers lower returns. Enterprises also have restricted access to loan money, contributing to economic recession. Interest rates rise when inflation occurs, which may be related to Walras' law.

- Credit risk. When savings interest rates are low, firms and people are more willing to spend and invest in riskier investments like securities. This spending stimulates the economy and injects capital into the markets, resulting in economic growth.

- Supply and demand. Supply and demand eventually determine interest rates. When credit is in great demand, creditors can raise their rates because they have more opportunities to lend money at higher yields. If there is a low demand for borrowing funds, creditors will cut their rates to make their offerings more appealing to potential debtors. Since borrowers may get loans at cheap interest rates, financial systems are frequently spurred during low-interest rates.

- Period of loan. The duration of the loan may additionally have a substantial impact on interest rates. In general, the higher the interest rate will offset any increased risks creditors bear over time. Short-term loans, for instance, provide several advantages, such as cheaper interest rates than long-term loans, such as mortgages or auto loans.

- Government policy. The government also establishes interest rates since it uses them to affect economic policies. Although governments want lower interest rates, they ultimately trigger market imbalance, in which demand exceeds supply, resulting in inflation. These adjustments typically have a cascading effect on various interest rates, including credit card rates and mortgages.

The correlation between savings accounts and compound interest

Compound interest is advantageous when accumulating money in a savings account. The interest gained on such accounts is compounded and is paid to the account owner as compensation for permitting the bank to utilize the deposited cash. Even when interest rates are at rock bottom, the snowball effect of compounding interest rates may help you develop income with time.

Borrower's Debt Cost

Whilst interest rates indicate interest revenue for the creditor, they also represent the borrower's cost of debt. Corporations compare the cost of borrowing versus equity investments, like dividend payments, to decide which funding source is the most affordable. Because most businesses raise capital by issuing debt or stock, the cost of capital is calculated to establish the best capital structure.

Discrimination and Interest Rates

Despite legislation prohibiting discriminatory lending practices, like the Equal Credit Opportunity Act (ECOA), institutional racism persists in the United States. According to a Realtor.com analysis published in July 2020, homeowners in predominantly Black neighborhoods are given mortgages with higher rates than purchasers in mostly White ones. According to its 2018 and 2019 mortgage data research, rising rates added over $10,000 in interest over a standard 30-year fixed-rate loan.

The Consumer Financial Protection Bureau (CFPB), which enforces the ECOA, released a Request for Information in July 2020, asking for public opinions to identify opportunities to improve what the ECOA does to ensure the equitable availability of loans. CFPB Director Kathleen L. Kraninger stated that clear guidelines help safeguard African Americans and other racial minorities, but the CFPB is obligated to assist them with measures to ensure creditors and others adhere to the law

Annual percentage yield (APY) vs. Annual percentage rate (APR)

The words annual percentage rate and annual percentage yield are frequently employed when discussing interest rates. Both are stated as percentages, but they have distinct connotations.

When you borrow money, you will be charged interest. The APY is the rate of return on savings. A loan is frequently connected with a higher APR. It comprises the interest rate on the loan's principal amount and any lender fees, such as points, origination fees, and other charges associated with getting credit. A higher APR signifies a higher borrowing cost.

APY, on the contrary, determines how much return you may expect on a financial asset over 12 months while taking compounding interest and other costs into account. When selecting an investment vehicle, aim for one with a higher APY, which implies that a more significant proportion of the funds you invest will be repaid in compound interest or other perks. You may also seek the advice of a financial professional to help you with your financial planning or lending needs.

Application of interest rates to the economy

Interest rates are a monetary policy instrument used by the Federal Reserve and other central banks worldwide. The central bank may impact many other interest rates, such as those on personal loans, corporate loans, and mortgages, by raising the cost of borrowing among commercial banks. This raises the cost of borrowing in general, cutting demand for money and cooling a hot economy. On the contrary, reducing interest rates makes borrowing money simpler, encouraging investments and expenditures.

Conclusion

The interest rate is the sum a creditor charges a borrower on top of the principal paid for using assets. An interest rate also pertains to the amount generated from a financial institution or credit union deposit account. The majority of mortgages employ simple interest. On the other hand, some loans utilize compound interest, which is applied not only to the principle but also to the accumulated interest from prior periods. A lender will charge a reduced interest rate to a borrower who is deemed low-risk. A loan with a high risk will incur a higher interest rate. The APY is the interest rate earned on savings or CDs at a bank or credit union. Compound interest is used in savings accounts and CDs.