What is the law of demand?

The law of demand is among the primary principles in accounting and finance. It corresponds with the law of supply to clarify how market economies distribute resources and set prices for products and services in everyday interactions.

According to the law of demand, the amount purchased varies inversely with cost. In simple terms, as the price rises, so does the amount demanded. This is due to declining marginal usefulness. Customers utilize the initial units of an economical product to meet their most pressing demands, then use each additional unit to meet gradually lower-valued purposes.

The concept of the law of demand

Economics explains how individuals use finite resources to meet boundless desires. The law of demand is focused on such limitless desires. In their economic conduct, people naturally prioritize more urgent demands and needs over less urgent ones, and this continues into how people pick among the limited resources accessible to them. For each economic good, the initial unit that a customer obtains tends to be utilized to meet the consumer's most urgent demand that the commodity can fulfil.

When all other market factors are equal, the per unit quantity requested of the item will be larger when the cost of that product falls. In contrast, the per unit quantity wanted of the commodity will be less when the price of that commodity rises. There are certain exemptions to the rule of demand and certain presumptions of the law of demand. The law of demand cannot be applicable in unusual circumstances. Furthermore, if the assumption changes, the law of demand will no longer apply. Nevertheless, the constraints or exceptions to the law of demand do not invalidate general law, which must be followed.

When customers buy goods on the marketplace, every extra unit of any given good or service is put to a less valued use than before, implying that they appreciate each additional unit to a lesser extent. They are prepared to pay less for the item because they esteem each extra unit less. As a result, the more units of a product that customers purchase, the less they are ready to pay in terms of price.

We may define a market demand curve constantly trending downward by adding up all the units of an item that customers are ready to buy at any given price.

Graphical illustration of the law of demand

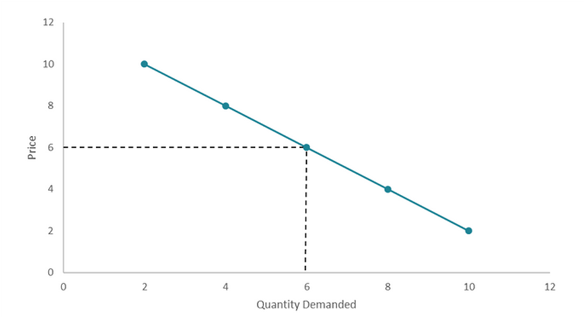

A graph is commonly used to depict the law of demand. The law of demand is represented graphically by a curve that demonstrates the link between the desired amount and an item's price.

The form of the demand curve varies depending on the type of item. The demand curve has a concave form most of the time. Despite this, the demand curve is depicted in certain economics textbooks as a straight line. The demand curve is shown against the amount desired (x-axis) and the price (y-axis). According to the definition of the law of demand, the demand curve slopes downward.

It is essential to differentiate between demand and the quantity demanded. The quantity required is the amount buyers are willing to purchase at a specific price. On the contrary, demand represents all potential correlations between the commodity's price and the amount required.

The assumptions and exceptions of the law of demand

Assumptions

Certain presumptions of the law of demand are required for the concept of the law of demand to hold. The assumptions are as follows:

· There is no change in customer tastes and inclinations.

· The pricing of the other goods remains unchanged.

· There is no change in population size.

· There is no anticipation that pricing will alter in the future.

· Consumer income does not change.

· There is no replacement for the product.

· Consumer habits should not change and should not be altered.

Exceptions

Unlike mathematics and science, the laws of economics are not universal. The law of demand, for example, has a few exceptions. Certain products have no inverse relationship between price and quantity. As a result, the demand curve for these commodities is trending higher.

· Giffen products

These substandard commodities lack close equivalents and account for a significant amount of the consumer's income. In the nineteenth century, Scottish economist Sir Robert Giffen hypothesized the existence of such things. Giffen commodities contradict the rule of demand since their prices rise proportionately to the desired quantity. However, because there is little empirical evidence of Giffen goods' existence in the real world, they remain mostly theoretical.

· Veblen products

Various kinds of luxury goods infringe the demand-supply law. Veblen products are named after Thorstein Veblen, an American economist. They are luxurious goods that reflect the owner's economic and social status. As a result, as the price of Veblen products rises, people are more likely to buy them. Luxury automobiles, premium wines, and designer clothing are examples of Veblen products.

· Income Variation

A consumer's or family's income change also influences the demand for a certain product. If the earnings of a family rise, they may decide to buy more of a particular product, regardless of price. Furthermore, if the earnings of the family fall, they can reduce their product consumption to some extent. It is opposed to the law of demand.

Demand vs. Demanded Quantity

It is essential in economic theory to differentiate between the phenomena of demand and the amount required. The phrase "demand" depicts the association between the urgency of a customer's wants and the quantity of the financial product available. A shift in demand indicates a change in the position or form of this curve; it represents a movement in the fundamental trend of consumer desires and requirements concerning the resources available to satisfy them.

Variations in the quantity required solely reflect price changes, reflecting no shift in the pattern of customer preferences. Changes in the quantity requested represent movement along the demand curve due to a price fluctuation. The above concepts are often confused, but this is a classic mistake since rising (or decreasing) prices do not reduce (or raise) demand; they vary the amount required.

Factors that affect the law of demand

Various factors can affect the shape and position of the demand curve. Rising salaries tend to raise demand for ordinary economic products since individuals are more eager to spend. Since they can satisfy the same consumer wants, and needs, the availability of comparable alternatives that compete with a specific economic good tends to reduce demand for that good. On the other hand, the availability of closely complementary commodities tends to enhance demand for an economic item because utilizing two things together might be more helpful to consumers than using them individually.

Additional variables, like future demands, changes in background environmental circumstances, or variations in an item's actual or perceived quality, might influence the demand curve because they alter consumers' preferences for how the commodity can be utilized and how urgently it is required.

Advantages and disadvantages of the law of demand

Regardless of being one of the key concepts upon which micro and macroeconomic factors are examined and determined, the law of demand and supply has several advantages and drawbacks that will be clear from the discussion below.

Advantages

There are various advantages to the law of demand, which provides opportunities for merchants, consumers, and other relevant parties. Some of the benefits are as follows:

i. It assists the party selling the various items in determining the pricing of their sold products. It will notify them whether they raise or lower demand pricing and the corresponding effect on the amount that its customers will desire.

ii. Analyzing the law of demand in economics is critical for every country's finance minister since changes in tax rates alter the pricing of various goods, affecting their demand in the market.

Disadvantages

The following are some of the limits and downsides of the law of demand in economics:

i. They are not applicable in every circumstance. For instance, if a war is soon to come, residents will start purchasing the necessary supplies and storing them for use during the war, even if the cost of those items continues to rise. Consequently, this is an exception to the law of demand because, even if the prices of goods rise, demand for those goods will not fall in a war situation.

ii. There are assumptions based on the law of demand. If assumptions are not met, the law of demand will not apply in such instances.

The law of supply

The whole amount of a certain commodity or service accessible to customers at a given price point is called supply. As a product's supply fluctuates, so does its demand, which directly impacts its price. The law of supply, subsequently, is a microeconomic law that states that all else being equal, when the price of a commodity or service rises, so will the amount that providers give (and vice versa). As a result, when demand exceeds available supply, the price of a commodity often rises. If the supply of an item increases but the demand remains constant, the price will fall.

The difference between the law of demand and the law of supply

The rule of demand is inextricably tied to the law of supply, which holds that when the market price of an item rises, sellers increase supply and vice versa. The distinction is that the law of demand concerns the consumer's reaction to price changes (such as whether they demand more or less of an item). In contrast, the law of supply concerns the supplier's reaction to price changes (whether they try to sell more or less of a good). Whenever financial analysts discuss these ideas together, they frequently address them as the supply and demand law.

The real-world application of the law of demand

The law of demand has practical implications in the real world. It is a guiding economic idea for politicians and policymakers. The rule of demand is fundamental to the monetary and fiscal policies pursued by governments worldwide. The policies usually aim to impact the country's economy by increasing or decreasing demand.

Is it possible to break the law of demand?

Yes. In certain circumstances, a rise in demand does not alter prices like the law of demand predicts. For instance, Veblen products are items whose demand rises as their price rises because they are viewed as status symbols. Similarly, demand for Giffen goods (which, unlike Veblen goods, are not considered luxury items) rises when prices rise and falls when prices fall. Bread, rice, and wheat are examples of Giffen products. These are frequent requirements and important products with few good replacements at comparable prices. As a result, even when the price of toilet paper rises, individuals may begin to stockpile it.

What is the significance of the law of demand?

Along with the law of supply, the law of demand assists us in comprehending why things are priced the way they are and determining opportunities to buy perceived underpriced (or sell perceived overpriced) products, assets, or securities. For example, a company may increase output due to higher prices caused by increased demand.

Conclusion

When prices change, the law of demand demonstrates consumer behavior. When the price of a commodity rises in the market, assuming all other factors influencing demand remain constant, the demand for that good falls. This is normal customer selection behavior. This occurs because a consumer is hesitant to spend more money on a product for fear of running out of money. Demand curves and schedules summarize the amount demanded vs. price relationship.