How is the Fiscal Year Measured?

A fiscal year represents a 52- or 53-week snapshot of a business or organization. Establishing a firm start and end date is important because it enables year-over-year consistency that can be used for proper:

● Accounting

● External audits

● Financial reporting

● Investor documents

● Tax payments

The start date of the organization’s fiscal year will be dependent on the nature of its operation. For example, the fiscal year for the U.S. federal government begins on October 1st and ends on September 30th.

Fiscal Year vs Calendar Year

Fiscal years do not necessarily need to align with calendar years. A calendar year starts on January 1st and ends on December 31st. However, a fiscal year can be any set of dates that are 12 months apart as long as it starts on the same date each year.

Fiscal years can be different from calendar years for a variety of reasons. The most common is because of the way it practices accounting.

For example, if the firm uses cash basis accounting, then it records transactions as they exchange hands. As they enter into a new calendar year, they may receive revenue or make payments that should actually count toward the previous calendar year. Rather than go through the trouble of switching accounting systems, the organization will simply establish a fiscal year that ends on a date other than December 31st.

Where Can I Find a Company's Fiscal Year?

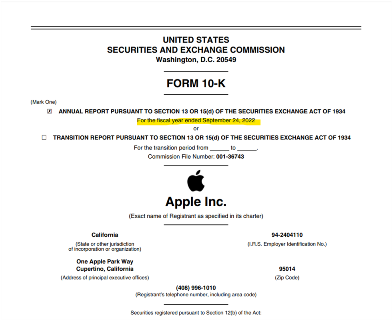

The dates associated with the fiscal year of any publicly traded company can be found in their annual report. The SEC (U.S. Securities and Exchange Commission) requires these organizations to formally submit a document called a 10-K, and they make them available online via the SEC’s website, sec.gov.

For example, the cover page of Apple’s 10-K shows that in 2022 its fiscal year ended on September 24th.

IRS Requirements

Establishing a fiscal year is not only important for maintaining financial recordkeeping but is also required by the IRS for tax reporting and payment purposes.

According to the IRS rules, a tax year can be established as either the calendar year or the company’s fiscal year. If in the first year …

● The business files its taxes using fiscal year, they can switch to calendar year at any time.

● The business files its taxes using calendar year, then it must file Form 1128 and get approval from the IRS before making a change.

The Bottom Line

A fiscal year is any 12-month period that an organization uses for accounting. It does not necessarily have to align with the calendar year. This is important not only for good recordkeeping and consistency but also because it is required by the IRS for tax purposes. The fiscal year of any publicly traded company can be found on their 10-K filed with the SEC.