What is a Roth IRA?

A Roth IRA is an individual retirement account that allows you to invest after-tax dollars to save for your retirement. Roth IRAs were created in 1997 and have grown in popularity among retirement savers because of their flexibility, tax advantages, and estate planning benefits. The main difference between a Roth IRA and other retirement accounts is that your contributions to a Roth IRA are not tax-deductible. However, once you have contributed to the account, the earnings will grow tax-free, and you can withdraw your funds tax-free during retirement.

To contribute to a Roth IRA, you need to have earned income, such as income from a job or self-employment. For 2023, you can contribute up to $6,500 per year (or $7,500 if you are 50 years old or older) into a Roth IRA. If you are married, you and your spouse can each have a Roth IRA, even if only one of you has earned income. However, the combined contributions to both accounts cannot exceed the contribution limit.

What are the differences between a Roth IRA and a traditional IRA?

The way contributions and withdrawals are taxed is one of the primary distinctions between a Roth IRA and a standard IRA. Contributions to a Roth IRA are made after-tax, so they are not tax-deductible, and future qualifying withdrawals are tax-free. Conventional IRAs are the inverse. Traditional IRA contributions are tax-deductible, tax-free, and future withdrawals are taxed as income.

The necessary withdrawal is another distinction between these two sorts of accounts. When you reach the age of 72 and have a traditional IRA, the IRS mandates you to withdraw a minimum amount each year. They are referred to as needed minimum distributions (RMDs). Because there are no RMDs in a Roth IRA, you can withdraw funds whenever you wish. If you don't need to withdraw your money, it can potentially grow tax-free.

Who’s Eligible for a Roth IRA?

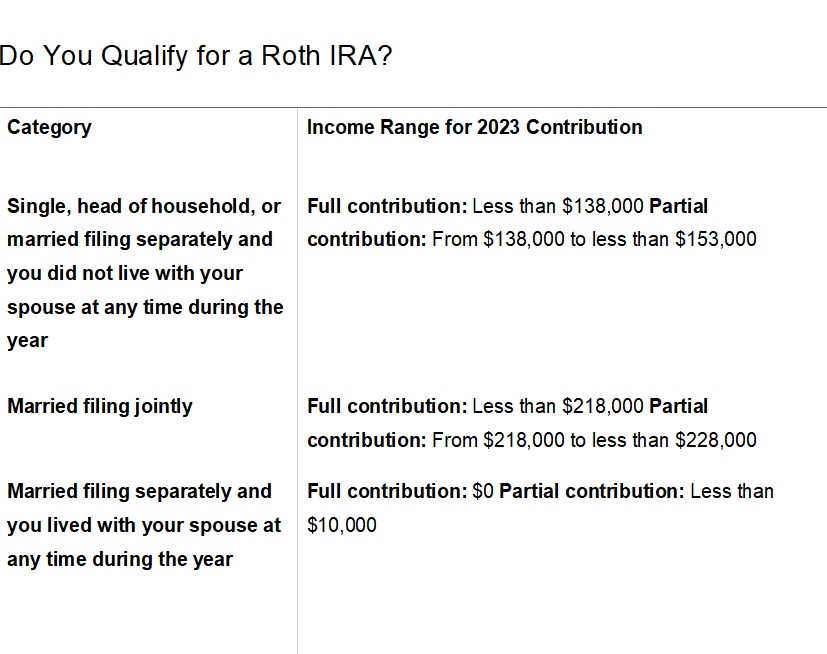

Anyone who has earned income can contribute to a Roth IRA—as long as they meet specific filing status and modified adjusted gross income (MAGI) requirements. Earned income can come from a job, self-employment, or even rental income. There are also income limits for contributing to a Roth IRA.

Individuals whose annual income exceeds a specific level, which the IRS modifies on a regular basis, are ineligible to contribute. The data for 2023 are shown in the chart below.

The system works as follows: Those earning less than the ranges shown for their respective category may pay up to 100% of their compensation or the contribution maximum, whichever is smaller.

People in the phaseout range must deduct their income from the maximum level and then divide it by the phaseout range to get the percentage of $6,500 that they can contribute.

Benefits of Roth IRAs

Tax-free withdrawals in retirement: Unlike traditional IRAs, where withdrawals are taxed as ordinary income, Roth IRA withdrawals are not subject to federal income tax, provided the account has been open for at least five years and the owner is at least 59 ½ years old. This tax-free feature can help retirees avoid paying higher taxes on their retirement income and can also provide greater flexibility in managing their retirement finances.

No required minimum distributions: Another advantage of Roth IRAs is that they do not have required minimum distributions (RMDs) during the lifetime of the owner. Traditional IRAs require owners to start taking RMDs at age 72, which can force retirees to withdraw more money than they need and potentially push them into higher tax brackets. With Roth IRAs, owners can choose to withdraw as much or as little as they need without worrying about RMDs.

Flexible contributions: With a Roth IRA, you can contribute up to $6,500 per year (or $7,500 if you're 50 or older). You can also withdraw your contributions at any time without penalty, which can be helpful in emergencies.

No age limit for contributions: With a traditional IRA, you can't contribute after age 72. With a Roth IRA, there's no age limit for contributions, as long as you have earned income.

Tax diversification:Having a mix of taxable and non-taxable retirement accounts can provide tax diversification, which can help manage your taxes in retirement. A Roth IRA can be an essential tool for tax diversification, especially if you expect to have a higher tax rate in retirement. By having a mix of taxable and non-taxable accounts, you can have more control over your taxable income and potentially reduce your overall tax bill.

Estate planning: A Roth IRA can also be an effective estate planning tool. Since withdrawals are tax-free, you can pass the account to your heirs, and they can continue to withdraw the funds tax-free as well. This feature can be especially beneficial if you have a high net worth and want to pass on your wealth to your heirs. Additionally, there are no RMDs for Roth IRAs, which means that you can pass the account to your heirs and let the money continue to grow tax-free for decades.

Lower tax rate during retirement: If you expect to have a lower tax rate during retirement than you do now, a Roth IRA can be an effective way to save for retirement. By paying taxes on your contributions now, you can take advantage of your lower tax rate and avoid paying taxes on your withdrawals during retirement when your tax rate may be higher.

Drawbacks of Roth IRAs

While Roth IRA has numerous benefits, it's also essential to consider the drawbacks to make an informed decision about whether it's the right retirement savings vehicle for you. Here are some of the main drawbacks of a Roth IRA:

Taxes on contributions: Unlike traditional retirement accounts, contributions to a Roth IRA are made with after-tax dollars. This means that you won't get a tax deduction for your contributions, and you'll have to pay taxes on the money you contribute. While this may not be a significant issue for some individuals, it can be a drawback for those who want to reduce their tax liability in the short-term.

Income limits: Roth IRA has income limits that determine who can contribute to the account. In 2023, individuals with a modified adjusted gross income (MAGI) of $153,000 or more and married couples with a MAGI of $228,000 or more are not eligible to contribute to a Roth IRA. This income limit can be a disadvantage for individuals who earn too much to contribute to a Roth IRA and want to take advantage of the tax-free withdrawals in retirement.

Contribution limits: Roth IRAs have contribution limits that limit how much you can contribute each year. In 2023, the contribution limit for individuals is $6,500, and for those over the age of 50, the limit is $7,500. While these limits may not be a significant drawback for some individuals, they can be a disadvantage for those who want to contribute more to their retirement savings.

No tax deduction: While not necessarily a drawback, it's essential to understand that contributions to a Roth IRA do not provide an immediate tax deduction. This means that if you're looking to reduce your tax liability in the short-term, a traditional IRA or 401(k) may be a better option for you.

Risk of legislative changes: Another potential drawback of a Roth IRA is the risk of legislative changes. While the current tax laws provide for tax-free withdrawals in retirement, there's always a risk that future legislation could change the rules. This means that individuals who have contributed to a Roth IRA may not receive the same tax benefits they had anticipated, making it essential to consider this risk when making investment decisions.

Allowable Investments in a Roth IRA

When it comes to investing in a Roth IRA, the options are virtually limitless. The IRS allows a wide range of investments in Roth IRAs, which include:

Stocks: Investing in stocks is one of the most common and popular ways to invest in a Roth IRA. This is because stocks have historically provided a high rate of return over the long-term. You can invest in individual stocks, exchange-traded funds (ETFs), and mutual funds that invest in stocks.

Bonds: Bonds are another common investment option in Roth IRAs. These include U.S. Treasury bonds, municipal bonds, corporate bonds, and bond funds.

Real Estate: You can also invest in real estate through a Roth IRA. This includes real estate investment trusts (REITs), which invest in real estate and pay dividends to shareholders.

Certificates of Deposit (CDs): CDs are low-risk investments that pay a fixed rate of interest for a set period. They are a good option for those who want a safe investment with predictable returns.

Exchange-Traded Funds (ETFs): ETFs are a popular investment vehicle that tracks a specific market index or sector. They offer diversification at a low cost.

Mutual Funds: Mutual funds pool money from many investors and use it to buy a wide range of stocks, bonds, and other assets. They are managed by professional fund managers and offer diversification and easy access to a range of investments.

Precious Metals: Roth IRAs also allow investment in precious metals like gold, silver, and platinum. These investments offer diversification and protection against inflation.

It is important to note that you cannot buy cryptocurrencies directly to your Roth IRA under IRS guidelines. Yet, the recent introduction of "Bitcoin IRAs" has resulted in retirement accounts that allow you to invest in cryptocurrencies. Other assets not eligible in an IRA, according to the IRS, include life insurance contracts and derivative trading. If you want the most investing alternatives, you should open a Roth self-directed IRA (SDIRA), which is a type of Roth IRA in which the investor oversees their assets rather than the financial institution. They open up a world of potential investments.

Additionally, it's essential to consider your investment goals, risk tolerance, and investment horizon when choosing investments for your Roth IRA. Working with a financial advisor can be helpful in developing an investment strategy that meets your unique financial situation and goals.

Opening a Roth IRA

Opening a Roth IRA can be a relatively simple process, and it’s a great way to start investing for retirement. Here’s a step-by-step guide to opening a Roth IRA:

- Choose a provider. There are many providers that offer Roth IRAs, including banks, brokerage firms, and online investment platforms. You’ll want to choose a provider that offers the investments you’re interested in and has low fees.

- Complete the application. Once you’ve chosen a provider, you’ll need to complete the application. This will include personal information, such as your name, address, and social security number.

- Fund the account. You can fund your Roth IRA with cash, investments, or a combination of both. You can also set up automatic contributions to make investing easier.

- Choose your investments. Once your account is funded, you’ll need to choose your investments. As we mentioned earlier, the IRS allows a wide range of investments in Roth IRAs, including stocks, bonds, real estate, CDs, ETFs, mutual funds, and precious metals. You’ll want to choose investments that align with your investment goals and risk tolerance.

- Review and adjust. It’s important to review your Roth IRA periodically and adjust your investments as necessary. This will help ensure that your investments align with your goals and risk tolerance as they change over time.

Opening a Roth IRA can be a great way to start investing for retirement. By following these steps, you can open an account and start building your retirement savings today.

The Five-Year Rule

The Roth IRA Five-Year Rule is an important requirement that determines whether any distributions made from your Roth IRA account are considered qualified distributions, meaning they are tax-free and penalty-free. The rule states that a Roth IRA account holder must have held the account for at least five years before making a qualified distribution.

In addition to the five-year rule, there are also two other criteria that must be met to make a qualified distribution from a Roth IRA account:

Age Requirement: The account holder must be at least 59 1/2 years old at the time of the distribution, or the distribution must be made due to disability, death, or for first-time homebuyer expenses up to $10,000.

Account Type: The distribution must be made from a Roth IRA account, not a traditional IRA or another retirement account.

It’s important to note that if any of these criteria are not met, the distribution may be subject to taxes and penalties. For example, if you make a distribution from a Roth IRA account that has not been open for at least five years and you are under age 59 1/2, the distribution will be subject to taxes and penalties on the earnings portion of the distribution. However, the contributions portion of the distribution will not be subject to taxes or penalties since those contributions were already taxed when they were made.

The five-year clock for the Roth IRA Five-Year Rule starts on January 1 of the tax year for which you make your first contribution to any Roth IRA account. For example, if you make your first Roth IRA contribution on April 1, 2022, the five-year clock starts on January 1, 2022. This means that the earliest you can make a qualified distribution from that account is January 1, 2027.

It’s important to keep track of the five-year clock for each Roth IRA account you own, as the clock may start at different times for each account. For example, if you open a second Roth IRA account in 2023, the five-year clock for that account will start on January 1, 2023, even if you already have another Roth IRA account that has been open for several years.

Are Roth IRAs Insured?

Yes, Roth IRAs are insured, but the extent of the insurance coverage depends on the type of investment account and the financial institution holding the account.

If your Roth IRA is held at a bank, it is insured by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000 per depositor, per insured bank. This means that if the bank holding your Roth IRA were to fail, you would be insured for up to $250,000.

If your Roth IRA is held at a brokerage firm, it is insured by the Securities Investor Protection Corporation (SIPC). SIPC protects up to $500,000 in cash and securities, including up to $250,000 in cash. This means that if your brokerage firm were to fail, you would be insured for up to $500,000 in securities, including up to $250,000 in cash.

It’s important to note that SIPC insurance does not protect against investment losses, nor does it cover all types of investments. For example, if your brokerage firm goes bankrupt and you have investments in commodities or futures contracts, those investments may not be covered by SIPC.

In addition to FDIC and SIPC insurance, some financial institutions may offer additional insurance coverage for Roth IRAs. For example, some insurance companies may offer additional coverage for annuities held within a Roth IRA.

Overall, while Roth IRAs are insured, it’s important to understand the extent of the insurance coverage and to choose a financial institution with a strong track record and reputation for safety and soundness. It’s also important to diversify your investments and regularly review your Roth IRA to ensure that your investments align with your goals and risk tolerance.

What Is a Spousal Roth IRA?

A Spousal Roth IRA is a type of Roth IRA that allows a working spouse to contribute to an individual retirement account (IRA) on behalf of a non-working spouse. The contributions are made to the non-working spouse's Roth IRA account and are subject to the same contribution limits as a regular Roth IRA.

To qualify for a Spousal Roth IRA, the couple must be married and file a joint tax return. The working spouse must have earned income at least equal to the contribution amount for both themselves and their non-working spouse. For example, if the contribution limit for the year is $6,000, the working spouse must have earned at least $12,000 to contribute the maximum amount for both individuals.

The Spousal Roth IRA is a great way for couples to save for retirement together and take advantage of the tax-free growth and withdrawals that a Roth IRA offers. It can also be a helpful tool for couples where one spouse is taking time off from work to care for children or family members.

The non-working spouse owns the Spousal Roth IRA account and has control over the investments and distributions. When the non-working spouse reaches age 59 1/2, they can begin withdrawing funds from the account tax-free as long as the account has been open for at least five years. If the account owner passes away, the account can be inherited by the surviving spouse and continue to grow tax-free.

It’s important to note that like a regular Roth IRA, contributions to a Spousal Roth IRA are not tax-deductible, and there may be penalties for withdrawing funds before age 59 1/2 or if the account has been open for less than five years. As with any retirement account, it’s important to consult with a financial professional to determine the best strategy for your individual situation.

Conclusion

Overall, a Roth IRA can be an excellent tool for retirement savings, especially for those who expect to be in a higher tax bracket in retirement. The benefits of a Roth IRA, including tax-free withdrawals in retirement, no required minimum distributions, flexibility with contributions and withdrawals, tax diversification, estate planning, and potential tax savings, make it a compelling option for retirement savings. As always, it's essential to consult with a financial advisor to determine if a Roth IRA is the right retirement savings vehicle for your unique financial situation.