How Does Modern Portfolio Theory Work?

The fundamental premise of Modern Portfolio Theory is that there is inherently a risk and reward relationship associated with every investment. Some may offer better gains, but this also comes at the cost of potentially greater losses.

Nonetheless, investors don’t have to expose themselves unnecessarily to risk in order to achieve better results. Instead, they can diversify their holdings by constructing a mixed basket of assets in proportions that optimize returns at an acceptable level of risk.

Furthermore, this portfolio must be constructed on two important assumptions:

● The assets you choose to invest in must be considered not just for their returns but how they will perform relative to one another.

● Since the future is unknown, the only reasonable way to gauge the potential performance of an investment is to use its historical returns as a basis.

In other words, this risk vs reward relationship can be quantified. Additionally, it can be optimized to achieve efficiency between the greatest potential returns given the investor’s specified level of risk.

Correlation

Correlation, the relative relationship between two assets, is an important consideration for Modern Portfolio Theory. This is because in order for a portfolio to effectively mitigate risk, its components need to provide a hedge over one another.

Essentially, all investment combinations can be categorized as one of three types:

● Positive correlation - When asset values move together in the same direction. For instance, an investor who buys stock in both Apple and Google may believe they’ve reduced their risk because these are two separate companies. However, because both stocks are within the technology industry, it could be argued that they are positively correlated with one another in the broader sense.

● Negative correlation - When asset values move in the opposite direction. The classic example are stocks and bonds. Typically when the stock market is down, investors flock to bonds for safety causing the price to increase. As stocks begin to rise, investors will then move away from bonds in search of better returns reducing their market price.

● Uncorrelated - When asset values have no intrinsic relation to one another. An example of this might be real estate and stocks. Real estate value can fluctuate for a variety of reasons having little to do with the performance of the stock market.

For Modern Portfolio Theory to be effective, investors want to prioritize combinations of assets that are either uncorrelated or that have a negative correlation. This gives them a better chance of maintaining net positive gains while reducing the overall risk profile.

The Efficient Frontier

While it can be assumed that some asset combinations will be more effective than others, it’s not apparent to the investor how much of each type of asset to hold. This is also not an easy question to answer because there can be an infinite number of possible portfolios that can be constructed.

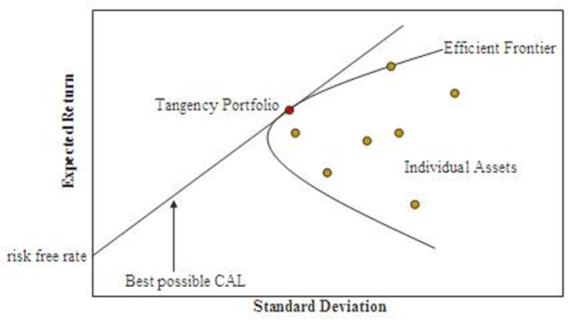

However, Modern Portfolio Theory makes this quantification possible by plotting them along a risk vs reward graph called the efficient frontier. The efficient frontier is essentially the most optimal of these portfolio allocations. It is often represented by a curve where the knee points to the left.

Expected Return

The y-axis of the efficient frontier is the expected return. This is found by taking the weighted value of each asset’s expected return and calculating a theoretical gain for the portfolio.

Risk (Standard Deviation)

The x-axis of the efficient frontier is the risk associated with each portfolio. Risk is measured using variation or the standard deviation of each asset’s potential return range.

For example, an asset such as a growth stock might vary widely from its average expected return and would therefore have a high level of variance. Meanwhile, an asset like a government bond might not stray too far from its mean and could therefore be thought of as having a lower level of variance.

Example

Conventional investment advice is to construct a portfolio made up of stocks and bonds. We can use Modern Portfolio Theory to determine our asset allocation.

● A portfolio made up of 75/25 percent stocks and bonds will produce high results. However, it will also be risky as it moves towards the right along the top of the efficient frontier.

● A portfolio made up of 25/75 percent stocks and bonds will produce lower returns. However, it too will be risky as it moves to the right along the bottom of the efficient frontier.

Therefore, to strike a balance between risk vs reward, we want a portfolio combination that’s as far to the left along the efficient frontier as possible and at a risk level the investor feels comfortable undertaking. This is why many financial advisers recommend portfolio allocations such as the popular 60/40 stock and bond combination.

The Challenges of Using Modern Portfolio Theory

While Modern Portfolio Theory provides a framework for optimizing risk and reward, it has received its fair share of criticism over the past few decades.

For starters, it's much too technical for the causal investors to use. Assembling a portfolio, calculating the expected return for each possible variant, and then equating this to a corresponding risk is outside the average person’s capacity. It requires special software and expertise to be performed properly.

Another issue some analysts take with Modern Portfolio Theory is that it's using historical data to make future predictions. While using historical data is better than nothing, it's also not a guarantee of how an asset will perform going forward. This is especially true when you consider external factors such as politics, trend changes, or other one-time events.

Furthermore, because Modern Portfolio Theory focuses on variance to measure risk, it is possible for two portfolios to have similar efficient frontier plots - one with frequent, smaller losses and another with larger but less frequent losses. It also assumes that investors make their selections based on rational decision-making even though it’s well-known that investors frequently make trades based on emotion.

The Bottom Line

Investors and financial managers can use Modern Portfolio Theory as a means of optimizing the performance of their holdings for a given level of risk. This can best be done by combining assets that are diversified with zero or negative correlation to one another.

Graphically, the risk-reward profile for each combination can be graphed and plotted along a trace called the efficient frontier. This provides the investor with a way to know which asset allocation will achieve the optimized based on the risk they’re willing to take.