How Do You Calculate Operating Profit?

Operating profit is a line item found on profit and loss (P&L) statements that show the earnings a company has made before interest and taxes have been paid.

Operating profit can be calculated as follows:

Operating Profit = Revenue - COGS - Overhead Expenses - Other Day-to-Day Expenses

Where:

● Revenue = The gross amount of money the company made from the sale of goods and services

● COGS (Cost of Goods Sold) = Expenses that can be tied directly to the products or services offered such as materials, direct labor, etc.

● Overhead Expenses = Expenses that are indirectly associated with the business such as administrative salaries, insurance, rent, etc.

● Other Day-to-Day Expenses = Depreciation and amortization related to the assets

Operating profit is often reported according to when the company prepares its financial documents. This is typically on a monthly, quarterly, and annual basis.

Operating Margin

Generally, operating profit will be used by businesses to calculate another useful metric called operating margin. This can be found by taking the operating profit and dividing it by gross sales.

Operating margin is helpful in understanding how efficient a business is at converting sales into earnings. The higher the number, the better the business is at converting revenue into profits for the shareholders. For this reason, investors will compare the operating margin of two or more companies within the same industry to gain some insight as to which one has better performance.

Gross Profit vs Operating Profit

Some P&L statements will show both gross profit and operating profit. However, these two figures represent different aspects of the company's financial situation.

Gross profit is simply found by taking the company's total revenue and subtracting away the COGS. By doing this, managers can determine how much money they are truly making once the expenses that are directly associated with producing the product have been removed. That can be useful to know, especially if the business makes and sells multiple products.

However, for businesses of all sizes, there will often be more expenses than just those directly attributed to the making of the item it sells. These indirect expenses must also be captured since they also reduce the company's profitability. Therefore, the P&L statement will list these expense lines below gross profit leading to a second calculation of operating profit.

Net Income vs Operating Profit

As with gross profit, another type of profit that appears on P&L statements is net profit. Also known as net income, this is the amount of revenue remaining after all expenses, including taxes and interest, have been deducted. For that reason, you'll often see it as the statement's "bottom line" figure.

Operating profit is sometimes preferred over net income because taxes and interest can be variable and non-reflective of how well the company is truly performing. For example, suppose a business made the same operating profit over two years, but federal tax rates increased from the first year to the next. If an analyst simply looked at net income alone, then they would have mistakenly thought that the company was not performing as optimally as the previous year. However, this would be false since the additional expense in tax was unrelated to the business itself.

Where Can I Find Operating Profit?

The financial information of any publicly traded company can be found in a handful of places. The first is the company’s own website. Generally, this will under a menu item or tab named “Investor Relations”. Click on the link and navigate to any link that shows the latest financial documentation for the business.

This same information will also be shown on various financial media sites such as Yahoo Finance. Trading apps will also usually make this information available.

Because each of these companies is financially regulated by the U.S. Securities and Exchange Commission (SEC), you can also find financial statements there as well. Visit the SEC’s website and search for the company of interest.

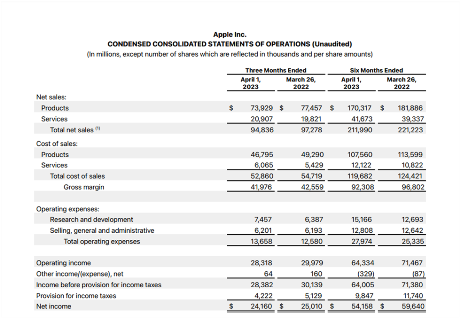

Below is a sample P&L statement from tech giant Apple (ticker: AAPL).

The Bottom Line

The operating profit of a company is the amount of revenue that remains after the COGS, overhead, and other day-to-day expenses have been subtracted. It does not, however, include taxes or interest.

Operating profit is helpful in understanding how much money the company is making after all expenses related to the business itself have been deducted. It can also be used to calculate operating margin and reveal how businesses are performing against competitors within the same industry.