How Does Prospect Theory Work?

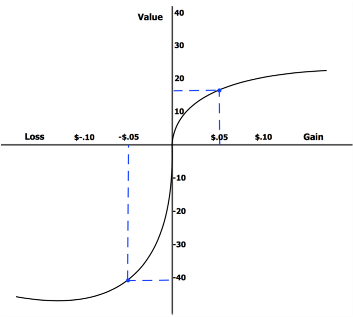

The characteristics of prospect theory can best be described by the following S-shaped diagram:

The graph is composed of two axes:

● The x-axis represents some quantity of an item. Although this could technically be anything that the individual values, it is usually measured in terms of money. Positive values indicate a gain while negative values indicate a loss.

● The y-axis represents the perceived value by the individual. Positive values indicate an increase in happiness while negative values indicate the feeling of pain.

The origin (0,0) represents the starting reference for the individual. At this point, they feel neutral.

As the S-curve moves into the first quadrant of the graph, the individual experiences happiness the more they gain something of value. However, that happiness eventually tapers off to the point where no further increase in quantity brings them any more joy (i.e. the point of diminishing returns).

At the opposite side of the S-curve in the third quadrant of the graph, the individual experiences pain as they lose something of value. However, take notice that this increase is much steeper than the opposite slope on the happiness side. Hence, the feeling of pain will be more severe for a loss than the same gain will create happiness.

Similar to gains, the S-curve eventually tapers off as well. This would also suggest that any further losses will not result in additional pain.

Prospect Theory Example

Consider the following scenario:

● Receiving a prize of $100

● Taking a “double or nothing” opportunity to gamble the $100 on a 50/50 chance to win $200

Even though both options have the same probable outcome (100% chance for $100 or 50% chance for $200), most people will take the first option. According to prospect theory, this is because the pain of losing $100 is not as rewarding as the possibility of earning $200.

Different Starting Points

Another major characteristic of prospect theory is that the starting point will be unique to each individual. This reference is also free to change over time as the individual’s perspective also changes.

For example, consider two investors:

● A younger investor with a net worth of $100,000

● A mature investor with a net worth of $1,000,000

Both are invested in the general stock market. Suppose after one year, the market is down 10 percent. In this case, the younger investor essentially lost $10,000 while the mature investor lost $100,000.

From the perspective of the younger investor, the $100,000 that the older investor lost would be substantial because it would have effectively wiped out their whole portfolio. However, because the mature investor’s starting point was $1,000,000 instead of $100,000, they do not perceive the loss in the same way.

Meanwhile, note that at some point in the past, the mature investor was also a younger investor. This means several years ago, a $10,000 would have been more painful than it is today. However, since their perspective has changed as they’ve aged, so has the starting point.

One could also use this idea of different reference points to explain why the euphoria of earning more money eventually dissipates as you become accustomed to it. For instance, someone earning $50,000 is very happy to take a new job that pays $100,000. However, someone else earning $100,000 may not feel as excited to go to $150,000 even though it's the same increase of $50,000.

Phases of Prospect Theory

Generally, prospect theory is accomplished through the following two stages.

1) Editing Phase

In the initial phase, individuals collect the information that they feel is relevant for making their decision. They will set a reference point and then prioritize the most desirable outcomes.

This stage is important because its where bias can be introduced. For example, if an investor sees the probability of a loss as being lower than it really is, then they might be inclined to pursue a risky investment because from their perspective the possibility for a gain is greater.

2) Evaluation phase

This is the stage where the individual makes their final decision and proceeds with the outcome they believe will give them the most utility. Typically, most people tend to be risk-averse when the stakes are high but risk-accepting when the stakes are low.

For example, suppose an investor can buy shares of a mutual fund that is known to return approximately 8 percent per year. Rather than invest $100,000 to get an $8,000 return, they might only invest $10,000 to earn $800. This is because if there’s a risk that the mutual fund might potentially lose 8 percent, then an $800 loss would not be bad as an $8,000 loss.

Prospect Theory vs Utility Theory

Prior to prospect theory, there was another widely accepted concept known as utility theory. Utility theory was proposed back in 1738 by Swiss mathematician Daniel Bernoulli.

Utility theory focuses on the gain or "utility" of how useful something is to the individual. Similar to the example above for prospect theory, it also concludes that a person would be more likely to take a $100 prize than to gamble on receiving $200. This is because it assumes people are rational and risk-averse. Hence, they will pick the option with more utility (or less risk).

However, Kahneman and Tversky recognized that utility theory didn’t go far enough to describe a person’s starting point. In other words, utility theory said that everyone would value that $100 gain in the same way regardless of their net worth. Yet, we know in reality that’s not true.

For example, when gambling, one person might be comfortable betting $100,000 while another person may only be comfortable wagering $1,000. If the person with the larger bet is a multi-millionaire, then they may not perceive the $100,000 as being that significant of a loss. Meanwhile, if the person with the smaller bet has a more modest net worth, then $1,000 might feel like a greater loss.

Therefore, prospect theory uses the same approach as utility theory but takes it a step further to reference it from the individual's reference point. Rather than making choices based on the potential utility of the options, prospect theory suggests that decisions are made based on the potential gain or loss from their individualized starting point.

The Bottom Line

Prospect theory explains why some people can be more loss averse than others. As depicted by an S-shaped diagram, the pain from a loss will be greater than the happiness experienced from a gain of the same magnitude.

This will be in relation to the individual’s starting point. Unlike utility theory which assumes all people value gains and losses in the same way, prospect theory measures those same gains and losses from the decision maker’s reference point. Hence, this is why some people may be more comfortable taking risks than others.