How capital gains tax works

Capital gains tax is based on the principle that an investor who makes a profit from the sale of a capital asset should pay tax on that profit. The tax is calculated based on the difference between the purchase price and the sale price of the asset. This difference is known as the capital gain.

The amount of tax that is owed on the capital gain depends on a number of factors, including the type of asset that was sold, the length of time that the asset was held, and the individual's tax bracket.

For example, if an individual purchased 100 shares of a stock for $10 per share and then sold those shares for $15 per share, they would have a capital gain of $500 ($15 - $10 = $5 x 100 shares = $500). Depending on the tax laws in their country, the individual may owe a certain percentage of this capital gain in taxes.

Types of capital gains

There are two types of capital gains: short-term capital gains and long-term capital gains.

Short-term capital gains occur when an asset is held for one year or less. These gains are subject to a higher tax rate than long-term capital gains. The exact tax rate varies depending on the country's tax laws and the individual's tax bracket.

Long-term capital gains occur when an asset is held for more than one year. These gains are subject to a lower tax rate than short-term capital gains. The exact tax rate varies depending on the country's tax laws and the individual's tax bracket.

In some countries, there are also special tax rates for certain types of capital gains. For example, in the United States, there is a special tax rate for capital gains from the sale of collectibles.

Calculating capital gains tax

Calculating capital gains tax can be a complex process, but there are some general steps that can be followed.

First, you need to determine whether you have a capital gain or a capital loss. If the sale price of the asset is higher than the purchase price, you have a capital gain. If the sale price is lower than the purchase price, you have a capital loss.

Next, you need to determine whether the capital gain is short-term or long-term. As we discussed earlier, short-term capital gains are subject to a higher tax rate than long-term capital gains.

Once you know the type of capital gain you have, you can use the appropriate tax rate to calculate the amount of tax that you owe. In some countries, there may be additional deductions or exemptions that can be applied to reduce the amount of tax owed.

In some cases, it may be possible to offset a capital gain with a capital loss. For example, if you have a capital gain of $1,000 and a capital loss of $500, you may only owe taxes on the net capital gain of $500.

Capital gains tax rates for 2022 and 2023

The capital gains tax rates for 2022 and 2023 in the United States are as follows:

For short-term capital gains (assets held for one year or less), the tax rate will remain the same as ordinary income tax rates, which can range from 10% to 37%, depending on your income level.

For long-term capital gains (assets held for more than one year), the tax rates will increase slightly for some taxpayers. The rates for 2022 and 2023 are as follows:

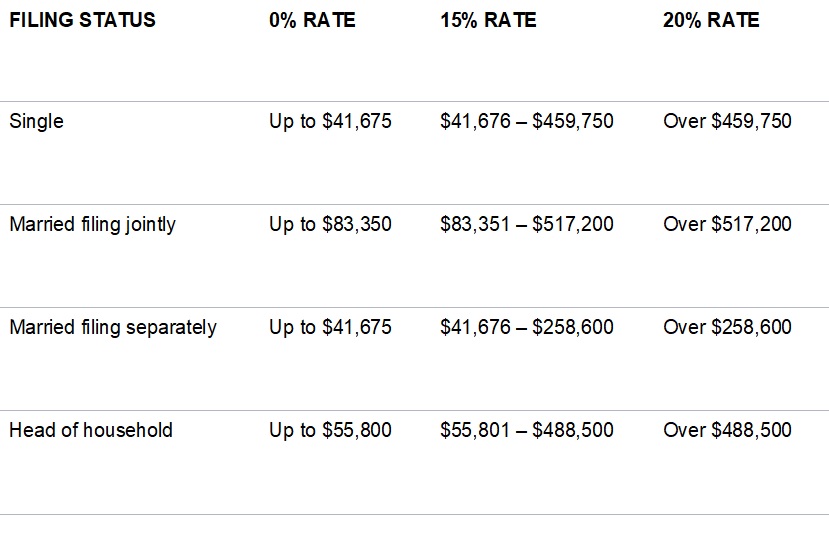

Long-term capital gains tax rates for the 2022 tax year

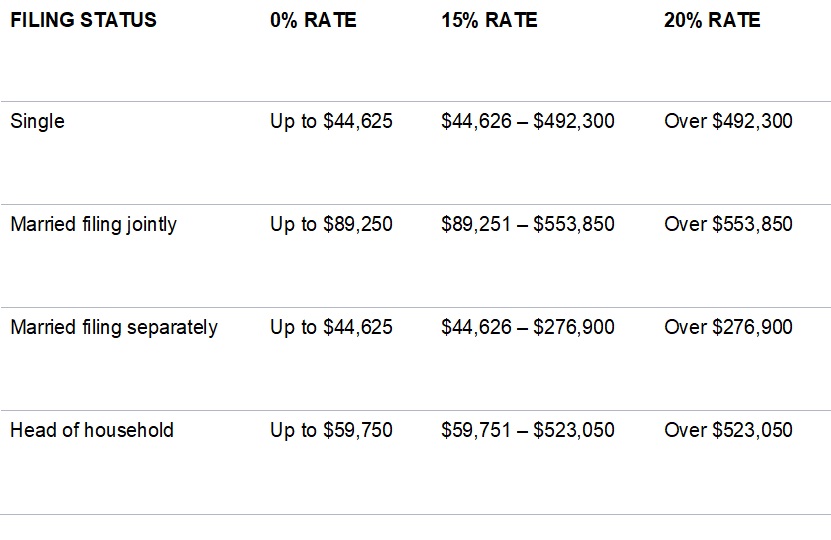

Long-term capital gains tax rates for the 2023 tax year

It is important to note that these rates are subject to change and may be influenced by future legislation. It is also important to consult with a tax professional for guidance on how these rates may apply to your specific tax situation.

When do you owe capital gains taxes?

Capital gains taxes are owed when you sell an asset for a profit, such as stocks, real estate, or art. The amount of tax owed depends on several factors, including the length of time you held the asset and your tax bracket.

If you sell an asset that you have owned for less than one year, the profit is considered a short-term capital gain and is taxed at your ordinary income tax rate. This rate can range from 10% to 37%, depending on your income level.

If you sell an asset that you have owned for more than one year, the profit is considered a long-term capital gain and is taxed at a lower rate than short-term capital gains. The long-term capital gains tax rate ranges from 0% to 20%, depending on your income level.

It is important to note that there are certain assets that are exempt from capital gains taxes, such as your primary residence (up to a certain amount of gain) and certain types of retirement accounts, such as traditional IRAs and 401(k)s.

In addition, if you have capital losses from the sale of other assets, you may be able to use those losses to offset your capital gains and reduce your tax liability. This is known as tax-loss harvesting and can be a useful strategy for managing your tax liability.

Overall, it is important to understand the tax implications of selling assets and to plan accordingly to minimize your tax liability. Consulting with a tax professional can be helpful in determining the best strategies for managing your capital gains taxes.

How can you avoid capital gains taxes?

While it is not possible to completely avoid capital gains taxes, there are several strategies that can be used to minimize the amount of tax owed. Here are some common strategies for avoiding or reducing capital gains taxes:

Hold assets for more than one year

As we discussed earlier, assets held for more than one year are subject to long-term capital gains tax rates, which are typically lower than short-term rates. Therefore, one of the most straightforward strategies for avoiding capital gains taxes is to hold assets for at least one year before selling them.

Use tax-deferred investment accounts

Investment accounts such as IRAs, 401(k)s, and Health Savings Accounts (HSAs) offer tax advantages that can help reduce or avoid capital gains taxes. For example, contributions to traditional IRAs and 401(k)s are tax-deductible, and gains in these accounts are tax-deferred until withdrawals are made in retirement. Withdrawals from HSAs are tax-free if used to pay for qualified medical expenses.

Donate appreciated assets to charity

Donating appreciated assets to a qualified charity is a tax-efficient way to avoid capital gains taxes. By donating the asset, the investor can avoid paying capital gains tax on the appreciation, and may also be eligible for a tax deduction for the value of the donation.

Offset capital gains with capital losses

Investors can offset capital gains with capital losses by selling investments that have declined in value. If the losses exceed the gains, the investor may be able to carry forward the excess losses to future tax years. This strategy is known as tax-loss harvesting and can be a useful way to minimize capital gains taxes.

Utilize 1031 exchanges

A 1031 exchange allows you to defer paying capital gains tax when you sell one investment property and use the proceeds to purchase another. This can be a useful strategy for real estate investors who want to avoid paying taxes on the sale of a property.

Use a trust

Creating a trust can be an effective strategy for managing capital gains tax liabilities. By transferring assets to a trust, the investor can avoid triggering capital gains tax on the sale of those assets. The trust can also be structured in a way that allows the investor to control the assets while minimizing the tax liability.

Plan ahead

Planning ahead is essential for minimizing capital gains tax liabilities. Investors should be aware of their tax situation and take steps to minimize tax liabilities well before the tax deadline. This may involve selling assets strategically, using tax-deferred accounts, and taking advantage of tax deductions and exemptions.

It is important to note that each strategy has its own requirements and limitations, and some may not be suitable for all investors. Consulting with a financial advisor or tax professional can be helpful in determining the best strategies for managing your capital gains taxes.

Conclusion

Capital gains tax is an important aspect of investing that should not be overlooked. It is important to understand how capital gains tax works, including the different types of capital gains and how to calculate the tax owed. By having a solid understanding of capital gains tax, investors can make more informed decisions about their investments and minimize their tax liability.