The significance of operating income is that it can reveal how well a company generates profits from its operational activities. For example, a business that generates $1 million in revenue but spends $750,000 would not be as attractive as a comparable one from the same industry that only spends $500,000 because it would only be half as profitable.

In general, the more operating income a company has, the more efficiently it operates. Additionally, having more operating income means the company has more resources to hire additional employees, buy equipment, expand capacity, etc.

What's Included in Operating Income?

Operating income (also sometimes referred to as operating profit and recurring profit) is calculated as follows:

Operating Income = Gross Income – Operating Expenses

These two components, gross income and operating expenses, can be further broken down.

Gross Income

Gross Income is a company’s revenue minus the cost of goods sold (COGS). In other words, if a company sells a product, then its gross income would be how much money it made after subtracting away the costs of all the materials needed to produce it.

COGS is also sometimes referred to as a “direct cost” because it can be attributed directly to the creation of a product or service offering.

Operating Expenses

Of course, COGS isn’t the only expense involved with the operation of a business. There are many other direct costs that also must be taken into consideration:

- Wages for production workers

- Freight to ship the products

- Power consumption for dedicated equipment

- Packaging

- Marketing

- Etc.

Depending on the business, there may also sometimes be indirect costs. Indirect costs are those operating expenses that are not attributable to a specific product or service but still must be considered. Examples may include:

- Facility rent

- Maintenance of the equipment

- Depreciation of the equipment

- Common utilities (water, electricity, etc.)

- Insurance

- Salaried employees (management, clerical, etc.)

- General office supplies

- Etc.

Oftentimes indirect costs will also be referred to as overhead costs.

Where Can You Find a Company’s Operating Income?

Operating income is one of the calculations performed as part of the GAAP (Generally Accepted Accounting Principles), the standard accounting method used by most U.S.-based companies. For any publicly traded company, you can find its operating income by looking up its income statement.

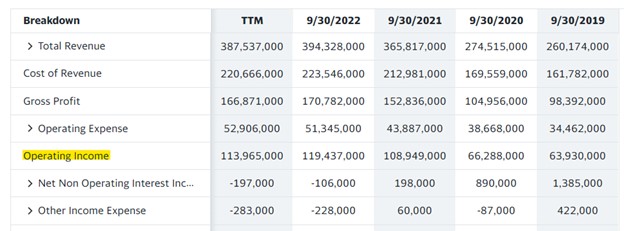

For example, here is an income statement and the operating income for the tech giant Apple (stock ticker: AAPL)

Source: Yahoo Finance

What’s Not Included in Operating Income?

There are several other inputs that operating income does not take into consideration:

- Taxes

- Interest paid

- Interest collected

- Investments

- One-time costs

- Etc.

When these items are also considered against operating income, the output is the business’s net income. Net income is sometimes referred to as “the bottom line” because it’s the last item listed on the company’s income statement.

The reason someone would want to compare the operating income of two businesses instead of net income is that net income can be skewed. For instance, a company might make a large one-time investment in one year but not the next. Additionally, the company may earn revenue from the interest it’s owed from the investments it holds. However, this interest income is not a direct result of its core operations. Filtering out this type of data and focusing instead on the operating income can help the company’s management and investors better understand its fundamentals and true performance.

Alternative Ways to Calculate Operating Income

There’s more than one way to determine the operating income of a business. For example, if we lump COGS in with direct costs, then the equation above may be rewritten as:

Operating income = Total Revenue – Direct Costs – Indirect Costs

Alternatively, this could also be stated as:

Operating income = Gross Profit – Operating Expenses – Depreciation – Amortization

Each of these equations can be referred to as a “top-down” approach because you start at the top of the income statement and work your way down. The same information could also be found using a “bottom-up” method starting from the bottom of the income statement. This can be done by taking the net earnings and working backward by adding back in interest and taxes:

Operating income = Net Earnings + Interest Expense + Taxes

The Bottom Line

Operating income is one of the key metrics used to understand the profitability of a business. While it does take into consideration COGS as well as other operational expenses (both direct and indirect), it’s not the same as net income because it excludes items such as taxes, interest, etc. It’s important for businesses and decision-makers to understand its significance and use it appropriately to gauge a company’s health and efficiency.