What is Amortization

Amortization is the process of repaying debt in fixed, periodic installments that include both principal and interest. Payments are made in the form of principal and interest in almost every context where the word amortization is used. In the context of a loan, amortization is the process of carrying out loan payments over a specified period. Amortization is analogous to depreciation when applied to an asset.

Perceiving what Amortization is

The word "amortization" relates to two distinct scenarios. For starters, amortization is a term used to describe the process of repaying debt by making regular main and interest payments over the course of time. An amortization plan is used to make monthly payments on an outstanding loan, such as a mortgage or an automobile loan, to lower the current debt. Secondly, "amortization" in accounting and taxes is deducting the cost of acquiring and developing an intangible asset from revenue over a defined period of time, usually the asset's useful life.

Amortization of loans

The first interest expense will be more than the subsequent ones since the initial principal sum would be larger. It also acts as motivation for the borrower to repay the debt. With time, more of each payment is applied to the loan's principle sum and less to interest.

Loans may take many forms and mean different things depending on the borrowers, lenders, and purposes involved. However, lenders and borrowers alike tend to prefer amortized loans because of the latter's predetermined schedule for full repayment. In this approach, both the borrower and the lender are protected against the negative effects of debt accumulation.

Most contemporary financial calculators, spreadsheet software programs (such as Microsoft Excel), and online amortization calculators may all be used to compute the amortization schedule. Lenders may provide a copy of the amortization schedule in their loan agreements (or at least specify the time period during which payments must be paid).

Calculation of the Amortization of loans

An amortized loan's monthly principal payment is determined using the following formula:

Principal Payment = TMP−(OLB × Interest Rate/12 Months )

Where:

TMP = Total monthly payment

OLB = Outstanding loan balance

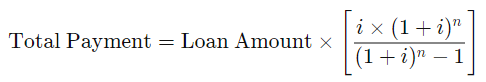

An amortized loan's total monthly payment is determined using the following formula:

Where:

i = Monthly interest payment

n = Number of payments

To get a monthly rate, divide the yearly rate by 12.

Amortization Schedule

Your first payments will mostly be used to interest rather than principal. The loan amortization schedule will demonstrate that as the loan term advances, a bigger portion of each payment goes toward reducing the principle.

Each loan payment has a period of time associated with it, often monthly. If a loan is due every two weeks or every three months, the duration will be the same since each row on an amortization schedule represents a payment. This column clarifies for both the borrower and the lender how the monthly payment will be divided up. This may be represented either by a number or a date. The following are the contents of the amortization schedule:

The outstanding debt that existed at the start of the allotted time frame is the initial loan sum. This might be the initial loan amount or the remaining balance from the previous month (the ending balance from the previous month is the same as the starting balance from this month).

The payment is the regular monthly cost determined before. Typically, this won't change throughout the duration of the loan. Payment is equal to the total principal plus interest, which is often calculated after the payment amount has been determined.

A loan's interest payment is simply the total amount of principal and interest covered by the loan's monthly payment. An easy way to determine this is to multiply the current interest rate by the amount still owed on loan. This interest rate might be determined by multiplying 1/12 of the interest rate by the initial debt, for instance, if payments are due every month. Be aware of how your APR is computed, applied, and compounded by your lender at all times. Interest payments should be adjusted such that they are less than their maximum percentage of the original loan amount.

The primary part of a payment is the whole amount not used to cover interest or fees. This is the total amount paid, less the interest cost for this time frame. Since interest is reduced as the loan amount falls, this column's value should rise as time progresses.

The outstanding loan balance is calculated by subtracting the principal amount from the initial loan sum. This is the adjusted debt amount once the next payment period has begun.

Mortgage amortization schedule

An amortization schedule for a mortgage is a table that details the timing and amount of each installment payment. The mortgage loan amortization schedule will illustrate the exact amount of every installment allocated towards paying interest and principal over the duration of the loan.

If you wish to speed up the process, you may make biweekly mortgage payments or additional contributions for principal reduction each month, or anytime you like. This strategy will have no influence on your budget while yet saving you a lot of money on interest. You should consider refinancing your mortgage if you can receive a cheaper interest rate or a shorter loan term. Refinancing entails considerable closing fees, so consider if the amount you save will exceed those upfront expenditures.

Another alternative is mortgage recasting, which involves keeping your present loan and paying a lump payment towards the principal, after which your lender will establish a new amortization plan indicating the current balance. The duration and interest rate of your loan will stay the same, but the monthly installment will be cheaper. With expenses ranging from $200 to $300, recasting might be a less expensive option to refinancing.

Finally, for homeowners enduring financial difficulties, a home loan modification brings the debt current. While a loan modification may help you to go mortgage-free sooner and decrease your interest burden, it may have a negative effect on your credit.

Intangible Assets Amortization

The intangible asset depreciation process is also known as amortization. In this context, amortization refers to writing off the price of an intangible asset over the item's expected useful life. Goodwill, trademarks, copyrights, and patents are all examples of intangible assets whose value may be depreciated over time. Like depreciation and depletion, which are applied to physical assets like infrastructure, structures, and automobiles that deteriorate over time, amortization is computed throughout the useful life of an item.

In line with generally accepted accounting principles (GAAP), organizations that amortize expenditures over time help link the expense of utilizing an asset to the revenues that it produces in the same accounting period. A long-term asset, such as a building, may provide a corporation with advantages over a prolonged period of time. As a result, it deducts the cost gradually during the asset's useful lifetime.

Intangible asset amortization is a fiscal planning tool in and of itself. Taxpayers can get a break from the Internal Revenue Service (IRS) on costs like those associated with atmospheric pollution control facilities; research and development R&D; geological and geophysical exploration for oil and natural gas; forestation and reforestation; bond premiums; lease acquisition; and intangibles like goodwill, patents, copyrights, and trademarks.

Pros and Cons of Amortization

Pros

- The fundamental benefit of amortization is the tax reduction it provides in the year of purchase, even if the item was not purchased with cash. You may deduct the cost of an asset from your taxable income as long as it is put to productive use. You may increase your earnings and expand your assets in this scenario.

- Timing is Critical. One of the amortization's most appealing features is the ability to minimize taxable income in higher-rate years. An alternative to the accelerated technique is to defer the deduction in a straight line if your income is expected to increase in subsequent years.

Cons

- If the borrower decides to prepay the loan, the lender will incur a loss of revenue due to the amortization process. Lenders will lose out on interest revenue if borrowers prepay big portions of their loan principal.

- Amortization might make it tough to resell a loan. A loan may be sold at a discount if the lender has to sell it before it has been paid off in full. This is due to the buyer taking over the remaining interest payments on the loan.

How essential is amortization?

Amortization is crucial because it enables companies and their investors to see how their expenses will be distributed over time. Amortization schedules help borrowers understand what percentage of their monthly payment goes toward paying down principal versus interest. This is helpful for things like interest payment tax deductions. Knowing how much debt remains after a certain amount of time has passed is also helpful for strategic planning purposes.

Intangible asset amortization is crucial since it lowers a company's taxable income and, by extension, its tax bill and improves transparency by letting investors see the company's genuine profitability. Trademarks and patents are two examples of intangible assets that might lose value over time owing to their short lifespans. The process of amortizing intangible assets also shows how a corporation has "used up" the advantage of these assets over time.

Comparing and contrasting amortization and depreciation

Both amortization and depreciation aim to measure the expense of owning an item over time. The fundamental distinction between them, nonetheless, is that amortization pertains to intangible assets, while depreciation involves physical assets. Intellectual property, such as trademarks and patents, is an example of an intangible asset. Property, such as buildings and automobiles, are examples of tangible assets.

Another variation is the accounting procedure in which various assets are decreased on the balance sheet. Amortizing a virtual asset is achieved by explicitly charging (reducing) that individual asset account. On the other hand, depreciation is documented by charging an account called cumulative depreciation, a counter-asset account. The previous price of fixed assets exists on a firm's books; nevertheless, the corporation additionally discloses this contra asset amount to report a net lower book value amount.

Finally, there may be discrepancies in the final calculations. This is particularly relevant when contrasting depreciation with the amortization of a loan. It is common practice to use the straight-line method to amortize intangible assets over their useful lives, while a much wider range of calculation methods (including the declining balance method, double-declining balance method, sum-of-the-years'-digits method, and units of production method) is used for amortizing fixed assets.

When Does a Negative Amortization Occur?

Negative amortization occurs when the principal balance of debt rises despite regular payments. This occurs when the sum of the monthly payments is less than the interest accrued on loan. With credit card interest rates reaching 20% or 30%, negative amortization poses a significant risk. You should try not to borrow more than you can afford and pay off your bills as soon as they are due.

Conclusion

Amortization is the practice of lowering a debt over time. Loans are amortized by applying a growing percentage of each monthly payment toward the principle. Similar to depreciation, the book value of an intangible asset is lowered by a specified amount each month as it is amortized. This method is used to demonstrate the gradual accumulation of an asset's value to the business.