What is the Equation for IRR?

The formula for IRR is derived from the equation for NPV set to zero:

0 = NPV = Sum [ Ct / ((1 + IRR)^t) ] - C0

where:

Ct = Net cash inflow during the period t

C0 = Total initial investment costs

IRR = The internal rate of return

t = The number of time periods

How to Calculate IRR

IRR can be easily calculated using any spreadsheet software such as Microsoft Excel. To do this, perform the following steps.

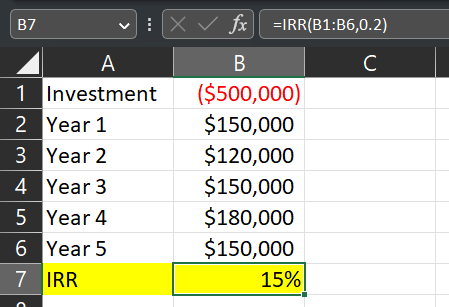

- Determine the initial investment amount. Since this will be money that leaves your pocket, it will be considered as negative cash flow and should be represented using a negative number. In the example below, we’ll use -$500,000.

- Define the length of time for the project. In most cases, this will be measured in years. In the example below, this investment will have a time horizon of 5 years.

- Estimate how much money that will be received each year as a result of this investment. Since this will be money coming back into your pocket, it will be considered a positive cash flow and should be represented using a positive number. In the example below please see the five positive cash flow amounts.

- Using Excel, type the formula "=IRR()". Within the brackets, highlight the values you entered starting with the initial investment and ending with the last cash flow. Excel will ask you to guess the IRR since behind the scenes it will be performing several iterations of this calculation and needs a starting point.

Here’s an example in Excel summarizing the steps above.

What Is IRR Used For?

The best way to conceptualize internal rate of return is to think of it as the estimated growth rate that an investment is expected to generate on an annual basis. Being well compensated for an investment is very important to businesses and investors alike, and the IRR provides them with the means to quantify variable cash flow in terms of the value of money today. This figure can then be used to evaluate if other opportunities could produce better returns or if alternate investment avenues should be pursued.

Examples 1 - Capital Investment

Suppose a company is thinking about buying a new piece of equipment so that it can expand its operations. As part of their pitch to the owners, management lays out what they anticipate the cash flow for the next five years would be as a result of this new equipment.

One way to evaluate this proposal would be to take the initial investment and compare it against the anticipated cash flows (after a discount rate has been applied) to get the NPV. Most companies do this using a value they set for themselves called the WACC (weighted average cost of capital).

However, IRR takes a different approach. With IRR, we already know ahead of time that the NPV should equal zero. Therefore, we can use the IRR calculation to find the discount rate for this specific situation. If the IRR is exceeding the company's WACC, then this may be a good indication that the purchase will be approved.

Example 2 - Comparing Projects

Suppose a company is bidding on two separate projects of similar durations. However, it only has the capacity to take on one of them. Before they can figure out which one they should more aggressively pursue, the IRR should be calculated.

Again, to get the IRR of each, initial investment and anticipated cash flows would have to be known. Since the calculation is designed to set both NPVs to zero, this makes it a fair comparison to see which one is truly more profitable.

Example 3 - Investing in Real Estate

IRR doesn't always have to be limited to a business or manufacturing environment. It can also be used to help investors with figuring out if an opportunity is worth the effort.

Let's assume a real estate investor has the chance to buy a home and use it as a vacation rental. He plans to collect rent for the next five years and then sell the property in the end. The investor could lay out his anticipated cash flow and then calculate the IRR to see how much he expects to earn.

This could then be weighed against other investment opportunities. For example, suppose the IRR of this deal was 15%. Meanwhile, his other option was to park his money in a bank CD (certificate of deposit) earning a 5% APR. Under these circumstances, the real estate investment would be the favored option.

IRR vs CAGR

Often times it’s easy to confuse IRR with CAGR or Compound Annual Growth Rate. However, the two metrics are not the same.

CAGR is a simple way to calculate the return on investment over a period of time. Rather than considering each individual year's cash flow, CAGR only looks at the initial and final values. This would be aligned with a buy-and-hold investor who buys a stock at the beginning of the year. Because they don't actually sell during the year and capitalize on the price fluctuations, those changes don't necessarily matter.

Disadvantages of IRR

As with most metrics in business, calculating the IRR alone for a venture does not give you the full picture. There are several aspects to the calculation that can be easily flawed.

For starters, if two projects are being considered that have different durations (for example five years versus ten years), then this can lead to a biased result. While the IRR for the ten-year project may be higher and initially seem more appealing, what if the company doesn't have ten years to wait and would rather receive more cash flow upfront?

Another fundamental drawback is that its future cash flows are always just estimations. For projects where the revenue is variable, it’s hard to make projections about how much income we’ll actually earn, and these approximations are really just educated guesses.

For these reasons, it's advised that IRR should not be used alone. Rather it should be considered along with context from other key performance indicators.

The Bottom Line

Internal Rate of Return is the discount rate needed to make the NPV of all future cash flows zero. It can be used to compare projects of similar duration to see which one could be more profitable. However, if used incorrectly, IRR can be misleading. For the best results, it should always be used in context with other metrics.